davis county utah sales tax rate

The exact property tax levied depends on the county in Illinois the property is located in. New Hampshire has an Interest and Dividends Tax of 5 scheduled to phase out from 2023 through 2026 and a Business Profits Tax of 85.

23 Lessons On Economic Development Economic Development Development Lesson

Click here for a larger sales tax map or here for a sales tax table.

. Tennessee is ranked 1952nd of the 3143 counties in the United States in order of the median amount of property taxes collected. Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335There are a total of 129 local tax jurisdictions across the state collecting an average local tax of 2108. Loudon County collects on average 045 of a propertys assessed fair market value as property tax.

According to a report released by Fair Tax Mark in 2019 Amazon is the best actor of tax avoidance having paid a 12 effective tax rate between 2010-2018 in contrast. New Hampshire has no sales tax. Amazons tax behaviours have been investigated in China Germany Poland South Korea France Japan Ireland Singapore Luxembourg Italy Spain United Kingdom multiple states in the United States and Portugal.

Combined with the state sales tax the highest sales tax rate in South Carolina is 9 in the. Combined with the state sales tax the highest sales tax rate in Utah is 905 in the city of Park. Utah County is located directly south of Salt Lake County in central Utah and is the states second-largest county by population.

The median property tax in Loudon County Tennessee is 746 per year for a home worth the median value of 166400. South Dakota no individual income tax but has a state franchise income tax on financial institutions. Lake County collects the highest property tax in Illinois levying an average of 628500 219 of median home value yearly in property taxes while Hardin County has the lowest property tax in the state collecting an average tax of 44700 071 of median home value per year.

The median annual property tax paid by homeowners in Utah County is 1517. Click here for a larger sales tax map or here for a sales tax table. South Carolina has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3There are a total of 120 local tax jurisdictions across the state collecting an average local tax of 1662.

That is the sixth-highest figure among Utah counties but is still more than 1000 less than the national median. Its largest city is Provo.

Explaining Closing Costs Escrow Realtor Realestate James Baldi Somerset Powerhouse Realtor Real Estate Tips Real Estate Infographic Real Estate Investing

Forbes On Twitter Best Places To Retire Ski Town Ogden Utah

Utah Sales Tax On Cars Everything You Need To Know

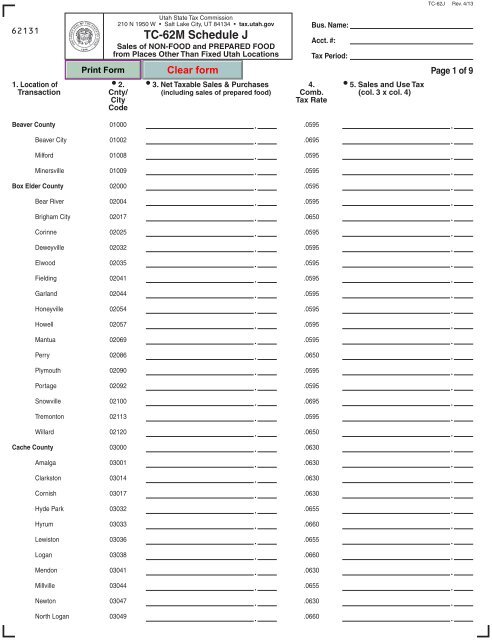

Tc 62m Schedule J Utah State Tax Commission Utah Gov

Utah Sales Tax Rate Increases Take Effect April 1 2019

Utah Income Tax Calculator Smartasset

Tc 62m Schedule J Utah State Tax Commission Utah Gov

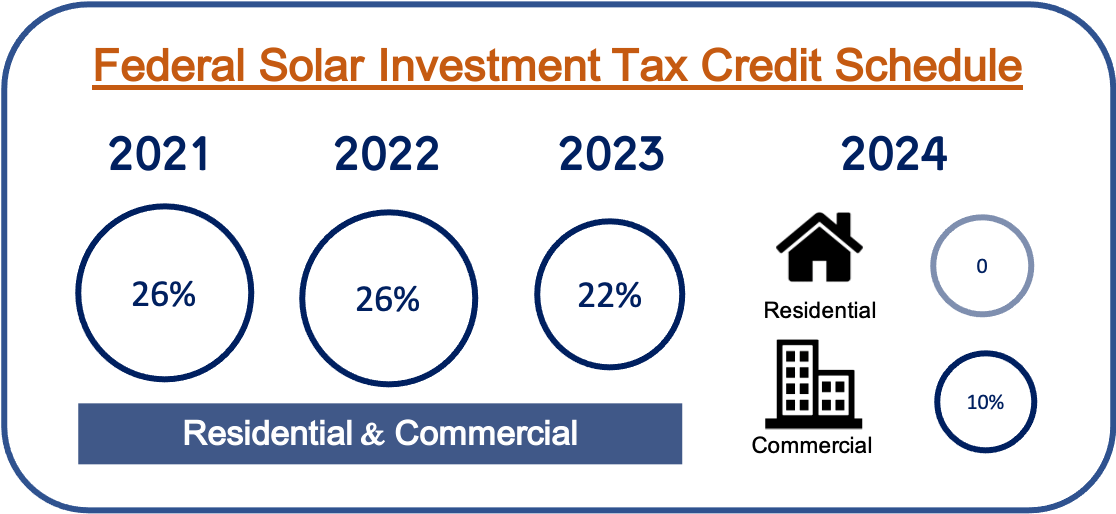

Solar Incentives In Utah Utah Energy Hub

Tc 62m Schedule J Utah State Tax Commission Utah Gov

Tc 62m Schedule J Utah State Tax Commission Utah Gov

Utah Sales Tax Rates By City County 2022

Found On Bing From Homemade Ftempo Com Entrance Design Supermarket Design Architecture

Map Of The Colonization Of America United States Map Missouri Compromise Civil War

Tc 62m Schedule J Utah State Tax Commission Utah Gov

Explaining Closing Costs Escrow Realtor Realestate James Baldi Somerset Powerhouse Realtor Real Estate Tips Real Estate Infographic Real Estate Investing